One of my favourite notions is that the spectrum of political affiliation is not, in the ultimate analysis, left to right. It's circular. We know this because of fashion.

British comedian Eddie Izzard illustrates this wonderfully in an elongated gag about being in fashion. You go from looking Ok, to looking trendy, to looking cool, to looking hip, to looking groovy, to looking like a dickhead. And if you continue around the circle, you look groovy, hip, cool, trendy to just OK. Consider red and yellow striped socks for example; they are perhaps cool, possibly groovy, but just a step away from dickhead.

In his book, Believe me: A Memoir of Love, Death and Jazz Chickens, he makes the comment that very advanced fashion almost joins up with having no fashion sense at all. Here is the youtube clip.

Politics works the same way, at least some of the time, and one of the reasons we know this is because of the the bizarre overlap between free marketeers and Marxists, particularly on some subjects - the notional “left” and “right” of the political spectrum. One of those overlaps is about currency and the State.

Neither Karl Marx nor Adam Smith wrote extensively about the state’s control of money - it was neither a central interest in their respective historic periods nor their own particular interest. But both, from different points of view, were critical of the monopolisation of power of any kind. So, superficially at least, they overlapped on the idea that the State’s control of the money printing press was somewhere between inevitable and specious.

Compare these two quotes for example: In Capital Vol. 1, Marx wrote: "The circulation of commodities is the original precondition of the circulation of money." And Smith in Wealth of Nations: "The circulating money of any country may be considered as all the wheels of circulation, in which the commodities of the country are transported from one hand to another for the convenience of society."

And what about the state’s control of the money printing press? Marx considered the state to be simply the committee for running the affairs of the bourgeoisie, and considered state control of the currency a natural and evil consequence of this fact. In the Communist Manifesto, he wrote: "The executive of the modern state is but a committee for managing the common affairs of the whole bourgeoisie."

Smith was a bit more nuanced, but still critical: "When national debts have once been accumulated to a certain degree, there is scarce, I believe, a single instance of their having been fairly and completely paid. The liberation of the public revenue, if it has ever been brought about at all, has always been brought about by a bankruptcy; sometimes by an avowed one, but always by a real one, though frequently by a pretended payment."

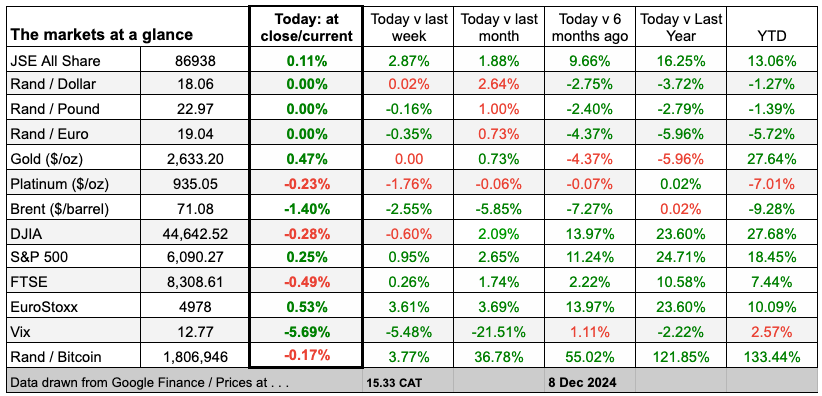

And that all brings us to Bitcoin. The price of Bitcoin has been screaming up since the election of Donald Trump as US president, following his conversion to Bitcoin support in the run-up to the election, Bitcoin briefly breached $100 000, and is now looking at R2-million.

There has actually been a good debate on Daily Maverick between two people whose views I respect on the subject of Bitcoin.

Fund manager Natale Labia writes, Bitcoin is now in a category called a “Veblen Good” asset - an asset that becomes more desirable as it gets more expensive. Though he says, “This new-found Veblen status, however, cannot last. Bitcoin and other cryptocurrencies are long into bubble territory.”

Steven Boykey Sidley counters, “Nothing could be further from the truth; Bitcoin’s ascendancy has only just begun.” The “Bitcoin-as-bubble” idea has been around for about 14 years but, in fact, Bitcoin has been the best-performing asset during that same period, he points out.

But the crux of the matter, Sidley says, is not the recent gains which attended the transition from a crypto-sceptical US administration to a supportive one, but whether Bitcoin in particular has joined the category of “strategic reserve asset”, along with US treasuries and gold. This is the question that actually intrigues me. It's also why the views of philosophers from both the notional left and right wings on the subject of the State and the currency are so interesting.

This is the key, isn’t it? The question is not really whether Bitcoin will rise or fall, as interesting as that may be (it may or may not, who cares?). The question is whether the population of the world now really becoming worried about total government debt?

It seems a bit obscure, but trust me, it is not. National debt is the common factor in this week’s collapse of the French political system, the bizarre and quickly withdrawn declaration of martial law in South Korea, and a host of other international developments. And the rise of Bitcoin, is conceptually, the mirror image of those trends.

In the French case, there were obviously many issues involved but behind them lay an attempt by the government to implement austerity measures to address fiscal imbalances which, as always, faced significant political resistance. In the end, these culminated in a no-confidence vote and the subsequent collapse of the government, which of course makes regaining market confidence even more difficult.

In South Korea, the immediate justification for martial law centered on national security concerns and political disputes. But behind them, the nation's economic challenges, particularly its national debt, have played a significant role in the unfolding events. In some senses, what happened in France is comparable; the tension between the need to constrain government spending and the political opportunities that doing so opens up for opposition politicians creates an avenue for gaining political advantage. South Korean President Yoon Suk Yeol's response to this pressure was extreme: the imposition of martial law. That increased the political instability, and the imposition was quickly lifted. But now of course there are calls for his resignation.

Just looking at the problem from the opposite point of view for a moment, is it possible to argue that actually the obsession with national debt is overdone? Or even if it is not, by worrying too much about debt do you close the door on the ability of the state to force feed the economy onto a higher growth path?

In SA, there is a whole plethora of economists and commentators who argue along these lines. Look at Japan, for example: Their national debt is now over 217% of GDP and the country seems fine. National debt is not like household debt because households can go bankrupt and governments can’t. Debt in one person’s hands is credit in another's. Honestly, these arguments make me tired.

It's of course true that governments can’t go bankrupt. But you know what? they can go bankrupt-ish. Just ask the South African government what that feels like. There was a story this week that the Western Cape is planning to build one school this year. One school. The Western Cape Education Department (WCED) issued a circular to principals, educators and school-based staff at public schools saying it faces a R3.8bn budget shortfall over the next three years and that consequently, it's cutting 2,407 teacher posts. God knows what the other provinces are doing: presumably worse.

The opposite argument supporting the hand-wringing and increasing global concern about national debt is simply that it's hard to explain the fact that not only Bitcoin, but gold, silver, copper, coffee beans for heaven’s sake, and a host of other goods outside the realm of currency are running at very high levels.

Taken together, I think the strategic reserve argument of Bitcoin is strengthening. It's worth remembering that this is all very new and different. It wasn’t really possible to hedge against global currencies collectively before. In the past, big money players would hold dollars, obvs, but also the pound perhaps, the Swiss franc, maybe some gold. But there is now an all-in-one option.

This is not to say, there aren’t risks, which are serious and also funny. One of the biggest Bitcoin bulls out there is Michael J. Saylor, executive chairman of a company called MicroStrategy. The company does essentially one thing: it sells its stock and generally raises debt to buy Bitcoin. There is other stuff, but it's trivial.

Bloomberg columnist Matt Levine describes the company like this: "MicroStrategy is primarily a pot of Bitcoins, though it also has a software business that is grudgingly acknowledged in its earnings release. The pot of Bitcoins is worth about $18-billion, according to that earnings release, and is funded partly with debt; MicroStrategy reports about $4.2-billion of long-term debt. This suggests a net asset value of, you know, $14-billion? Plus or minus 50%? Its market capitalisation is about $50 billion".

That’s distinctly red-flaggy to me as a strategy. And then there is the New York Mayor who asked to take his three salary cheques in Bitcoin. NYC Mayor Eric Adams this week took a victory lap over the issue, saying “Remember Y'All Laughed When I First Got My Bitcoin? Who's Laughing Now?” Well, we would be laughing if it were not for the fact that Adams is probably going to jail next year after being charged with bribery and campaign finance violations.

I’m not a financial advisor, but generally speaking for the rest of us I would say this: if you don’t own any Bitcoin, I can't do any great harm in devoting a percentage point of your wealth, however big or small it is, to crypto-currency. I bought Bitcoin a long time ago. I sold it too early. I bought a little more. Life goes on. It seems fine.

But what we all should not forget is what Bitcoin over $100 000 tells us and that is much less benign.

ICYMI: After the Bell🔔: Why is SA's economy not growing.

From the department of the 52 things I learned this year

Life is learning

This is wonderful! Every year Tom Whitwell announces the 52 things he learns every 52 weeks - here is his list for this year. The include that the weight-loss drug Ozempic is a is a modified, synthetic version of a protein discovered in the venomous saliva of the Gila monster, a large, sluggish lizard native to the United States.

From the department of quite a lot of work for not much gold

Talking up the gold price

There is about 0.03 grams of gold in the circuitry of every mobile phone. Gold is a great conductor, it's corrosion resistant, durable and heat resistant, up to a point.

With the gold price now so high, the value of that gold is now around $2 per phone. So doesn't that mean there is a market in mining cellphones, and wouldn't that be simpler, not to mention more healthy, than being a Zama Zama and eating cockroaches in the old Stillfontein mine.

Well, yes. But of course they do it in India already, turns out. This is how.

This is the process used for extracting gold.

by u/GinaWhite_tt in interesting

From the department of language expansion and simultaneous social commentary

X-odus (noun) /ˈɛks-oʊ-dəs/

The decision to leave X for somewhere else.

The new hottest product in tech is Bluesky, which is adding some one million users a day since the US election. CEO Jay Graber says the platform will never have ads, since ads are the road to “enshittification.” Another new word!

Thanks for reading, more this (and every) Wednesday. Please do share this newsletter with anyone who might be interested.

Join the conversation