Just when South Africans thought load-shedding was a thing of the past, it has returned. It's like the Creature from the Black Lagoon or any other horror movie villains - they always return because we can’t resist a sequel.

However, there was a bit of a coincidence here: after 10 months of load-shedding-free operation, Eskom announced that Stage 3 load-shedding would return immediately, just two days after regulator Nersa rejected Eskom’s 36% proposed increase, instead approving a 12.7% increase for electricity tariffs in 2025.

So one doesn’t want to be overly suspicious, but are these two moves linked? Private sector electricity expert Chris Yelland said the coincidence of the two events was “really unfortunate” and would “fuel a lot of loose talk”.

Well, as an old journalist friend used to say, it's much better to believe in the conspiracy and be proved wrong than not to believe in it and be proved wrong. But even if the conspiracy theory is wrong, there is a story here, as I will explain.

On the conspiracy theory: Eskom itself specifically rejects the notion. Eskom CEO Dan Marokane described the load-shedding as a “temporary setback". He said over the past seven days, Eskom had experienced several breakdowns that required extended repair times. “This has necessitated the use of all our emergency reserves, which now need to be replenished”. Load-shedding is “largely behind us,” he said.

So why persist in the notion that there might be a link? The short answer is money. Eskom’s requested increase was so outrageous - particularly in the context of the declining cost of electricity production globally - the only conceivable reason is that Eskom had included the cost of huge quantities of diesel for its Open Cycle Gas Turbine stations.

The link between load-shedding and a lower-than-applied-for electricity price vests in the notion that with a lower projected income, Eskom can’t run these diesel-powered stations as long as they might otherwise. I asked Yelland about this and he said it was possible, but he hadn't seen any evidence of this yet. "But...Eskom has been running the OCGTs hard due to loss of three units at Matimba and three at Lethabo, using a lot of diesel, and running low on onsite diesel at the power plants."

Well, we will see over the next few months. However, the return of the Creature from the Black Lagoon does raise larger questions about SA’s electricity provision that have been on the back burner as South Africans have breathed a sigh of relief about the notional end of load-shedding.

Now, consider a couple of hard facts. First, Eskom is producing less electricity today than in 2012, despite the population increasing by some ten million people. (Fabulous set of graphs produced by Nat Bullard here)

Then, there is the history of Eskom's above-inflation increases. The latest increase granted by Nersa is much less what Eskom wanted, but it's still a chunky increase over inflation. And that, by the way, has been the pattern every single year for the past decade. These figures, inflation-adjusted, from Nersa via ChatGPT.

And this is on top of a special appropriation for Eskom introduced by the then-Finance Minister Tito Mboweni of R59-billion in 2020, which was comprehensively smashed by Pravin Gordhan’s allocation of R254-billion in 2023.

All of this takes place in the context of an absolutely huge global reconfiguration of electricity provision. This is what has happened to global consumption of power. It's just incredible:

The per-capita consumption of power is increasing on average, notably in India and China, although it's noteworthy that consumption is decreasing per capita in lots of developed countries too … and South Africa. Obvs.

And of course, the rise of renewable energy has been astounding, and is continuing to gather steam.

South Africa is modestly part of this trend, as you can see from the above graph, and this one, depicting SA's imports of solar panels:

So what has been happening here and why should we be worried? This is my guess:

The essential problem is that Eskom’s leadership from former CEO Jacob Maroga onwards and the respective and ever-changing boards could not get their heads around renewable energy. Maroga still today tweets the same stuff he has continually been saying fifteen years after he left Eskom: SA should focus on coal; renewable energy is unreliable and intermittent because, you know, the sun doesn’t shine at night. As though coal power is super reliable. Even today, the position on Eskom's board for a renewables representative is vacant. They just don't know from renewables and they just don't care, somewhat understandably since they have such huge headaches elsewhere like, you know, bankruptcy.

This is amazing if you consider the global background over the past decade. Just look at what has happened to renewable energy costs over the past 15 years: prices have imploded. How do you just ignore that?

But when load-shedding became a huge political issue for the Ramaphosa administration this decade, the president had no choice but to allow South African businesses to generate their own power with the 100KW allowance and as the graph above demonstrates, the SA private sector went nuts.

Various rounds of bidding have taken place for solar projects. Some have got off the ground, but not nearly to the extent expected because, from Eskom’s point of view, the power generated is expensive. And it's expensive in part because the bidding rules require huge BEE components, which ramp up the production cost. The net result is that outside the private sector, SA's transition to renewables has been sub-par internationally.

The result of this sequence is that Eskom has been, by choice, excluded from producing electricity from the cheapest source of new energy available, which is solar photovoltaic with battery storage. As Eskom has opened new coal power plants, it has closed old ones and its total power production has remained static. The real reason we have not had load-shedding is not Eskom’s sudden managerial improvement but because there is now less stress on the grid because so many industrial outlets are generating their own electricity.

That means Eskom’s customers are declining, particularly industrial applications (previously regular payers). And that is why, even after the most enormous bail-outs imaginable, it's still short of money and needs huge price increases, while those huge price increases will mean lower usage.

So, the new bout of load-shedding might not be a revengeful Nersa, nor part of a surreptitious political manoeuvre to implicitly show the politicians who has the leverage here. But that doesn’t mean there isn’t a big underlying problem.💥

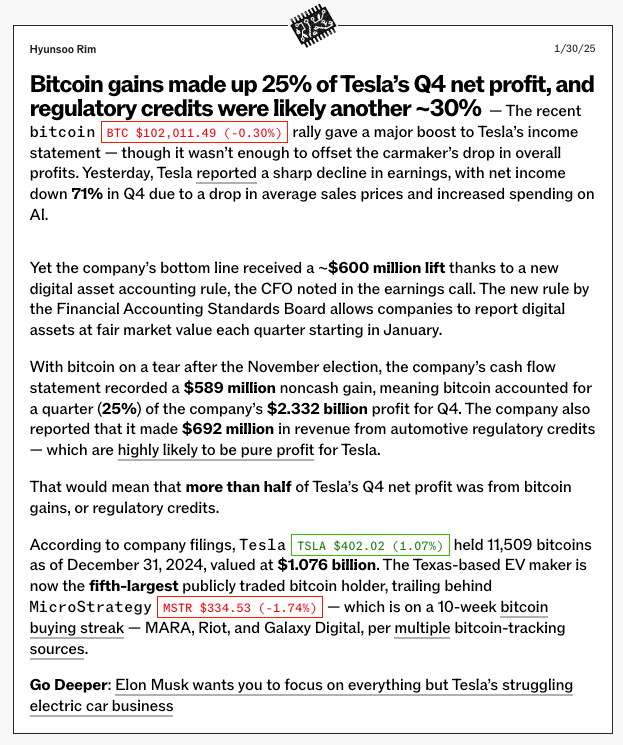

From the department of now we know why Elon likes to keep his politicians onside ...

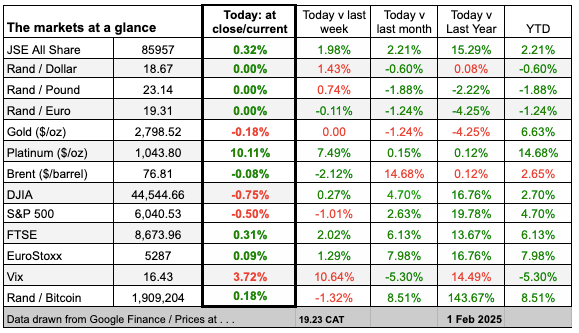

From the department of it honestly doesn't feel like it from here ..

From the department of at least now we know ..

Thanks for reading this post - please forward it to anyone you might think would be interested. Social media is now so clogged, its not a great recommendation tool, and personal references really helps enormously.

Don't hesitate to let me know where you agree or don't agree in the comments or directly. Till next time.

Tim

Join the conversation