Thank goodness for the occasional hot mic. What politicians say all over the world is now so scripted, and controlled, and preordained, that it's a pleasure when a politician, or banker, or anyone in authority really, says something truly embarrassing over a hot mic.

In one of the best examples captured just before the 2008 financial crash, a banker at a closed-door meeting was caught on a hot mic saying, "Honestly, we're all screwed, but let’s not start a panic." The next day Lehman Brothers collapsed.

What you get is that odd, ephemeral thing: the truth. And, as we all know, that is truly rare.

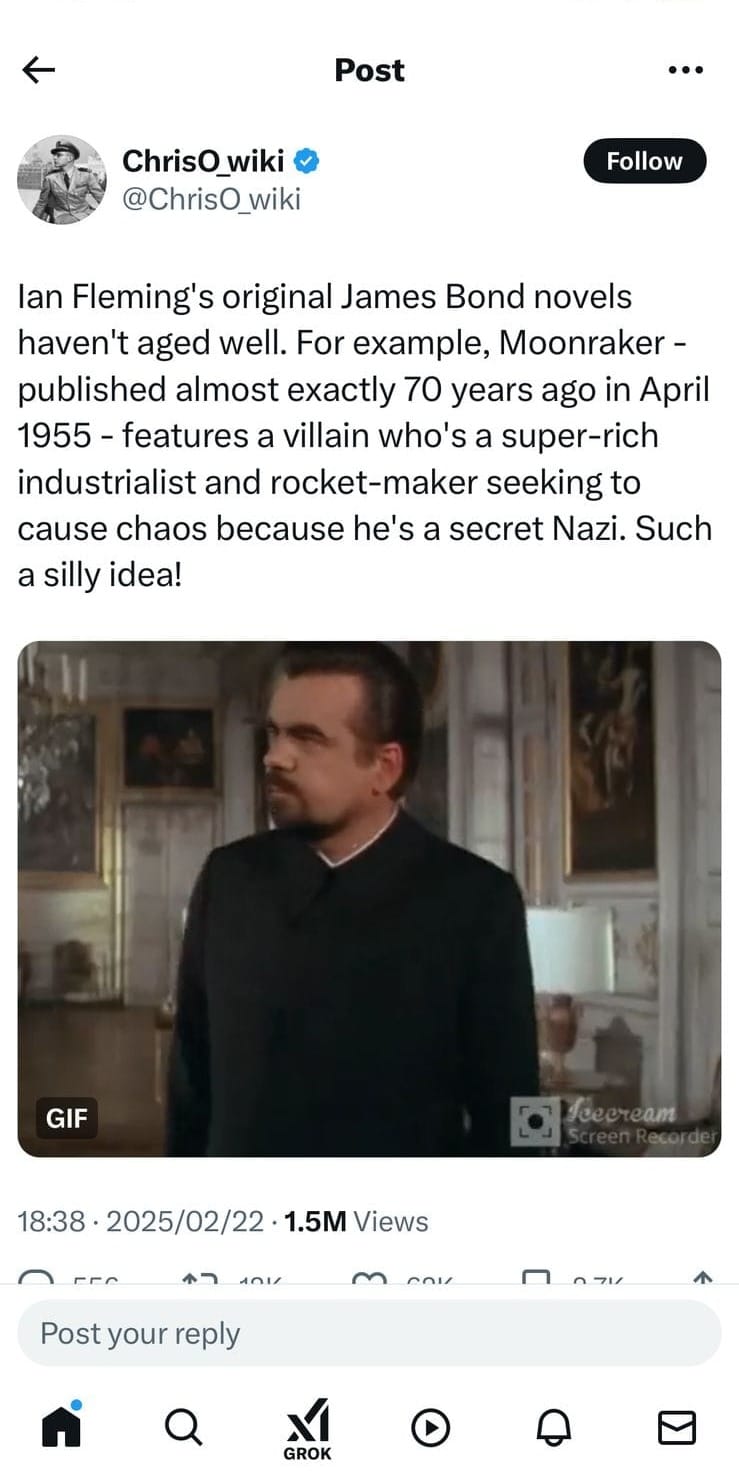

And so it was last week when finance minister Enoch Godongwana was caught on an open mic complaining about his own tax administration and the SA Revenue Service's commissioner Edward Kieswetter at the end of his non-budget press briefing in Parliament on Wednesday.

The stakes really cannot be much higher. It's been a shocking, and embarrassing, and revealing week for the Treasury. As we now all know, for the first time in democratic South Africa’s history, the annual budget address was postponed after a last-minute cabinet meeting, held on the day the budget was supposed to be announced, failed to elicit support for a shocking proposed VAT increase from 15% to 17%.

This delay has shattered the Treasury’s plan to just smash through a big tax increase, which is now going to be the subject of intensive negotiations in the government of national unity. Welcome to the New World, politicians of the ANC: as SA's largest party, you can no longer unilaterally impose more and more and more tax increases with impunity as you have been doing for the past few decades.

Anyway, back to the hot mic. What happened was that at the press conference, Godongwana was asked about a report in Business Day that quoted Kieswetter expressing reservations about hiking taxes. Kieswetter argued that the government should invest in SARS instead to bring in the estimated R800 billion in tax that the authority hasn't been able to collect.

The fact that Kieswetter made these comments made it widely assumed that big tax increases were unlikely but it turns out that Kieswetter either wasn’t part of the discussions around the tax increase just a few weeks ago, or his views were considered and rejected. Either way, this is not a good look.

Anyway, at the press conference, Godongwana said he contacted Kieswetter and that the commissioner claimed that his words were taken out of context. "I ask you people to go and ask him. Go and ask him … because when I saw this thing in the Business Day, I called him and the commissioner said, 'No, no, no, I said it some three weeks ago, but not in the same context.'"

Godongwana also hinted at this irritation during the same press conference, saying, “I do know the different roles between the two of us. His role is tax administration. My role is tax policy... It's quite important both of us will keep to those two lanes in doing that.”

But this was a milder version of what he said on the hot mic. As reported by News24, Finance Director-General Duncan Pieterse congratulated Godongwana on how he handled the question.

"I'm glad you took the question to the commissioner. You answered it much better than I would have done," Pieterse whispered, not realising the microphones were still on.

Godongwana responded: "I was worried I should not be angry."

"No, no, but you did well," said Pieterse, to which Godongwana responded: "He is making me angry. I said we were discussing … even here he comes up with this rubbish and I said how will it help me on the 19th, even now on the 12th."

Minister in the Presidency, Khumbudzo Ntshavheni then chipped in, asking in Zulu: "Uhamba nini yena?" (When is he leaving?) Clearly, Ntshavheni had forgotten that Kieswetter's term was scheduled to end on 30 April 2024 but President Cyril Ramaphosa asked him to stay for another two years.

What lies behind all of this is a very obvious difference in philosophy and approach, and here is the truth of it: Kieswetter is right.

The reason he is right is because of a long-established, well-known, researched to the n-th degree syndrome called the Laffer Curve which suggests that increasing tax rates beyond a certain point (the revenue-maximizing rate) can actually reduce total tax receipts. According to a ChatGPT review of academic work on the subject, in this model the peak occurs around 40%, meaning tax rates higher than this could discourage economic activity, leading to lower overall revenue.

This is how the model would look for revenue-maximizing tax rates for VAT, corporate tax, and personal income tax:

- VAT Revenue (Green Curve): Peaks around 20% (SA is currently at 15%, so there may be room for a slight increase).

- Corporate Tax Revenue (Blue Curve): Peaks around 30% (SA recently reduced corporate tax to 27%, suggesting it's close to optimal).

- Income Tax Revenue (Red Curve): Peaks around 40% (SA's highest tax bracket is currently 45%, meaning higher rates might already be reducing tax receipts).

So, technically speaking, the graph illustrates that the impact of increasing VAT from 15% to 17% would result in a whopping estimated 82.3% increase in VAT revenue. That would take VAT receipts from around R490-billion to R840-billion. You can see why the treasury was so keen on the increase, particularly since it has a whole range of new demands, including paying for Grade R schools, higher cash handouts to the poor, real increases in the education and health budgets, just to name a few.

But here is the problem; this has all been tried before. In 2018, government was facing a revenue shortfall of about R48.2-billion, mainly because bailouts were notionally necessary for Eskom, SAA, and the SABC. So VAT was increased by a single percentage point from 14% to 15%.

At the time of the 2018 Budget presentation, the government said they expected the VAT increase to raise R22.9-billion. In fact, VAT revenue for 2018/19 did increase from R289-billion to R324.6 billion, up from R298-billion in 2017/18, a R35-billion increase.

But because of inflation and other factors, the revenue increase would probably have been about R32-billion anyway. Hence, actual additional revenue from hiking the VAT tax came in at only about R3.7-billion.

So we learned that while VAT is the most difficult tax to avoid, it doesn’t always result in what you expect because in a context in which growth is slow and economic confidence is low, consumers respond to a tax increase by saving, not spending.

As it happens, Treasury was working on the basis that the increase in revenue would be much lower than the technical increase would garner. The proposed adjustment was projected to generate an additional R58 billion in revenue for the 2025/26 fiscal year. Consequently, the total VAT revenue for 2025/26 was estimated at R545.4 billion.

Yet, is it even realistic? If a single percentage point increase brought in only R3.7-billion seven years ago in the context of low growth, why would a two-percentage point garner more than R8-billion? The problem is that the structure of SA's wealth is different from what general models on which the Laffer curve is based.

SA's tax fragility is very apparent in what we know about personal tax, but its also relevant to VAT. As pointed out in Currencynews, only 4.2 million South Africans are net personal income taxpayers. There is a wafer-thin slice of wealthier South Africans, fewer than 350,000, who earn more than R1-million per year, and who pay nearly half the total personal income tax. So, the country’s income hinges on 0.5% of the population. As it happens, that very small group of four-and-a-bit million people are also doing most of the heavyweight buying too, and they in particular respond to tax increases by saving rather than spending at the same rate.

It seems apparent to everyone in South Africa other than our government that there is a cost-of-living crisis happening at the moment in most of the country. But the real insult is something else that was said at the press conference: spending cuts were not considered. I am not making this up.

Dit it not occur to anyone in a government which has 32 ministers and 43 deputy ministers that it might be an idea to look at the expenditure side of the budget? That really tells you everything we need to know about the financial nouse of the majority party. 💥

From the department of going, going, definitively gone..

From the department of pure, complete, total fiction...

From the department of making surgery really, really stick ..

From the department of Your Honor, ChatGPT made me do it ...

Thanks for reading this post, please do recommend it to friends ... and enemies. Till next time. 💥

Join the conversation